I’m not talking about the mini tuxedo you bought for your dog. Before you know it, you’ll have some discretionary funds for your hobby.Īnother reason to keep track of spending: mistakes happen. (Yes, I did that.) What seems like a low monthly payment can quickly add up through the course of a year. Maybe you’re paying for two Netflix accounts because you had to watch Tiger King immediately and you forgot the password on your original account. In the day and age of subscription payments, you may be paying recurring fees for products or services you no longer need. Tracking spending may sound like a depressing exercise, but what if I tell you that you’re almost guaranteed to find extra money? To master your finances, you MUST know where your money is going. This the scary part, but it’s oh-so-enlightening. If you do turn to the internet, be sure you’re working from a financial plan that’s customized for you, like with this free tool from Planswell. Google can’t tell you exactly what to do this time. When managing your finances, make sure you are doing it with YOU in mind. In addition to your priorities, many other personal factors will significantly impact your financial wellness and your best plan of attack, such as your income, age, family status, debt, assets, investments, risk tolerance, and much more. There is no right or wrong answer, nor judgement. Reflect honestly on this question: would you rather look rich or feel rich? This will tell you if you should spend your money on material things or life experiences. In your new relationship with your finances, money has one purpose: to power your ideal life. Now is the time to rewrite your money story. Is that weekly splurge at the mall just mindless spending, or is it more like “retail therapy” to fuel your metaphorical tank? Is there a hobby you set aside because you could no longer afford it? Put it back on your list. If travel feeds your soul, put it at the top of your priority list. Most of us have a finite amount of resources and we need to make some choices. Your relationship with money should be all about supporting your ideal life. Now is not the time to keep up with the Joneses. Make It All About Youįirst things first, your finances need to work for you. Where should you start? I’ll break it down for you. Simply get started in the right direction and you can make progress on all three at the same time.

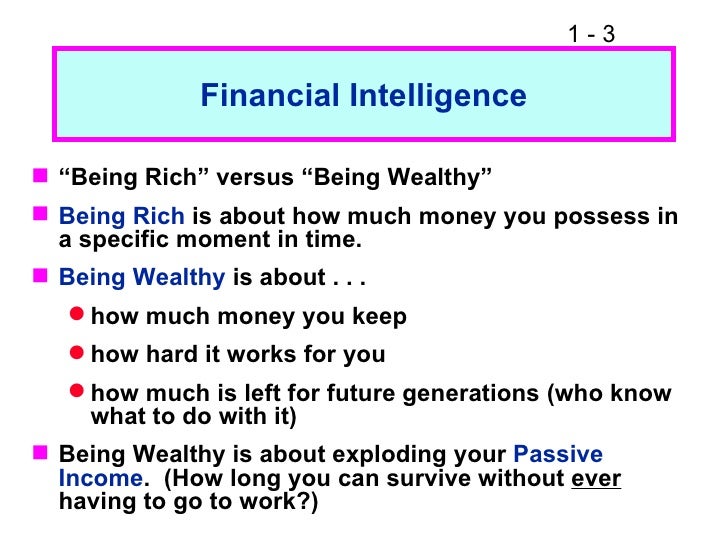

In your financial life, there are three levels of actualization: financial literacy, financial wellness, and financial independence. It is done -every day-by millions of people. Whatever your financial situation is, please know there are millions of people out there who’ve been in a worse position than you and who’ve made it to the other side. You can go ahead and tune out those “experts” who say you need to start saving in utero. Even if you feel behind in the financial aspects of adulthood, there is hope for you. Do these words send you into a mini panic attack? Finance.

0 kommentar(er)

0 kommentar(er)